You can claim dry cleaning expenses on your taxes, but only if your clothing passes the IRS’s strict two-prong test: your employer must require it, and it must be completely unsuitable for everyday wear. Think firefighter gear or medical scrubs, not your sharp business suits—I learned this the hard way during my first audit! 😅 Regular business attire, even expensive ones requiring professional cleaning, simply don’t qualify since you could theoretically wear them to dinner or social events. Understanding these nuanced requirements can help you maximize legitimate deductions while staying compliant.

Understanding IRS Requirements for Clothing Deductions

When I first started doing my own taxes years ago, I made the classic mistake of thinking I could deduct my expensive suits since I wore them to my office job every day—until my accountant gently crushed that dream 😅.

That expensive work wardrobe you’re so proud of? The IRS doesn’t care how sharp you look.

The IRS has strict rules about clothing deductions that caught me completely off-guard. Your clothing must pass their two-prong test: it needs to be required by your employer AND unsuitable for everyday wear.

Business expenses like dry cleaning expenses only qualify if the clothing meets these criteria. Think firefighter gear or medical scrubs—items you’d never wear to grab coffee.

Tax deductions for regular business attire simply don’t exist, no matter how much you spend on maintaining those sharp looks.

If you do qualify for clothing deductions, make sure to keep detailed receipts and records that prove the clothing’s exclusive work-related purpose.

Two-Prong Test for Qualifying Work Attire

The IRS two-prong test sounds intimidating, but it’s actually pretty straightforward once you break it down into digestible pieces.

First, your employer must require the clothing as a condition of employment—think uniforms with company logos or safety gear that’s mandatory for your job.

Second, the clothing can’t be suitable for everyday wear outside work, which honestly trips up most people trying to deduct dry cleaning expenses.

I learned this the hard way when I tried claiming my business suits, thinking “I only wear these for client meetings!” 😅 But since you could theoretically wear a suit to dinner or social events, it fails the second prong.

Keep in mind that percentage limitations based on your adjusted gross income may also apply to qualifying dry cleaning deductions.

When evaluating clothing expenses for your tax deduction, consider consulting a tax professional if you’re unsure about qualification requirements.

Types of Clothing That Qualify for Tax Deductions

You’ll find that the IRS recognizes three main categories of work clothing that can lighten your tax burden, and honestly, understanding these distinctions saved me from making costly mistakes during my first year as a freelance consultant.

Your uniforms and specialized work attire must pass that strict “not suitable for street wear” test, while protective safety equipment like hard hats and steel-toed boots qualify automatically since nobody’s wearing those to brunch 😊.

Costumes and specialized gear for performers, religious leaders, or other professionals also make the cut, but remember, if you can rock that outfit at Target without getting strange looks, it probably won’t pass the IRS smell test.

Uniforms and Work Attire

Although it might seem straightforward at first glance, determining which clothing qualifies for tax deductions can feel like maneuvering through a maze blindfolded—trust me, I’ve been there scratching my head over whether my friend’s “business casual” polo shirts counted (spoiler alert: they didn’t).

Here’s the golden rule: your work clothes must be so job-specific that you’d never wear them grocery shopping 🛒.

Police officers can deduct their uniforms because nobody rocks tactical gear to brunch, while nurses can write off scrubs since they’re exclusively for healthcare settings.

Firefighters, construction workers with hard hats, and theater performers in elaborate costumes all qualify because these items serve one purpose only.

The IRS wants proof your clothing is genuinely necessary for work and completely unsuitable for personal wear—making these legitimate business expenses worth pursuing.

To support any dry cleaning deductions you claim for qualifying work attire, maintain detailed records and receipts as documentation for your business expenses.

Protective Safety Equipment

When your job puts you in harm’s way, the IRS actually becomes your ally in protecting both your safety and your wallet—something I learned after watching my electrician brother religiously save receipts for his flame-resistant coveralls and insulated gloves.

You can deduct protective safety equipment that’s exclusively for work, including hard hats, safety goggles, steel-toed boots, and specialized clothing that meets industry standards.

The key is proving these items aren’t suitable for everyday wear and are required by your employer. Healthcare workers can claim medical scrubs, construction workers their harnesses, and firefighters their specialized gear.

Keep detailed receipts for both purchases and maintenance costs, because the IRS wants proof that these clothing expenses are genuinely protecting you on the job.

Your safety investment pays double! 💪

Costumes and Specialized Gear

While my accountant friend used to joke that her Halloween costume budget was her biggest annual expense, she discovered that performers, entertainers, and specialized workers can actually turn their costume and gear purchases into legitimate tax deductions.

If you’re wearing costumes exclusively for performances or specialized gear that’s not suitable for everyday wear, you can deduct the cost from your taxes. This applies to actors’ costumes, safety equipment like hard hats, medical scrubs, and employer-mandated uniforms that aren’t appropriate for personal use.

Small businesses especially benefit from these deductions, though proper documentation of all costs remains crucial. Keep detailed records including receipts and documentation proving the business necessity of these specialized clothing items. Always seek professional tax advice to guarantee you’re maximizing these opportunities while staying compliant with IRS requirements.

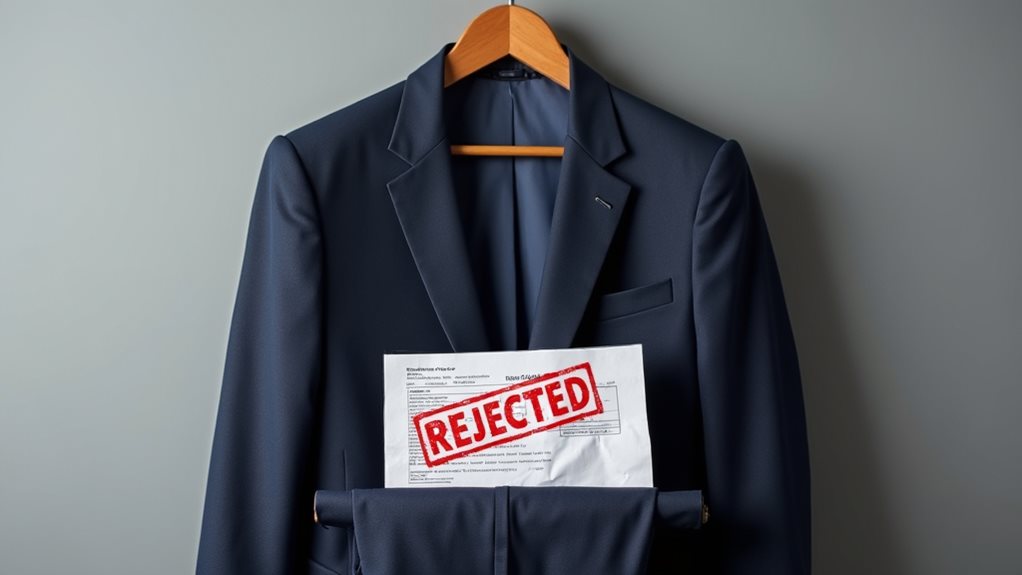

Why Business Suits Don’t Meet Deduction Criteria

Since the IRS created its two-prong test for clothing deductions, I’ve watched countless business professionals learn the hard way that their sharp-looking suits don’t qualify for tax breaks, no matter how much they cost or how often they wear them exclusively to the office.

Here’s the reality check: your business suit fails both prongs of the test because it’s suitable for everyday wear, and honestly, you could throw on that same suit for dinner dates or social events without looking out of place.

Even if your small business requires professional attire and you’re faithfully following IRS guidelines about work clothing, you can’t deduct dry cleaning costs for suits because they’re considered general wardrobe items, not specialized work gear that screams “I’m only wearing this for my job!”

This is why maintaining detailed records with receipts and business necessity documentation becomes crucial for any clothing-related deductions you might legitimately claim.

Special Circumstances for Dry Cleaning Deductibility

Although most business clothing won’t pass the IRS’s strict deductibility test, there are specific situations where you can legitimately claim dry cleaning expenses, and I’ve seen taxpayers miss these opportunities simply because they didn’t know the rules applied differently in certain circumstances.

Business travel creates one golden exception – when you’re traveling for work, those hotel dry cleaning bills become deductible expenses, though sadly, cleaning costs once you’re back home don’t qualify under IRS regulations.

Specialized work attire like uniforms, protective gear, or industry-specific clothing that you’d never wear to brunch also opens the door for legitimate deductions.

The key is meeting both prongs of the IRS test: your employer requires it, and it’s genuinely unsuitable for everyday wear.

For expenses under $75, the IRS may not require receipts, but you’ll still need to maintain detailed logs showing the business purpose, date, and amount to substantiate your claims during an audit.

Record Keeping and Documentation Requirements

If you’ve ever scrambled through shoeboxes of crumpled receipts during tax season, frantically trying to reconstruct your business expenses while questioning every life choice that led to this moment of organizational chaos, you’ll understand why meticulous record keeping becomes your best friend when claiming dry cleaning deductions.

Your documentation needs to tell a clear story that satisfies the IRS’s requirements, and honestly, it’s not as complicated as you might think:

- Keep every receipt showing date, amount, and business purpose – your future self will thank you

- Separate personal dry cleaning from business expenses immediately to avoid confusion later

- Store records for three years minimum, because audits happen when you least expect them

- Organize by year and expense type for stress-free tax preparation

Remember that employees face stricter limitations with miscellaneous itemized deductions and must meet specific thresholds that have been significantly restricted under recent tax law changes. Smart record keeping transforms tax deductions from nightmare to manageable routine.